Innoviva, Inc.

Supplier Financial Health Report

Overview

June 2024

USA

Incorporated Country

112

Number of Employees

A+

Credit Rating

8

Count of Investments

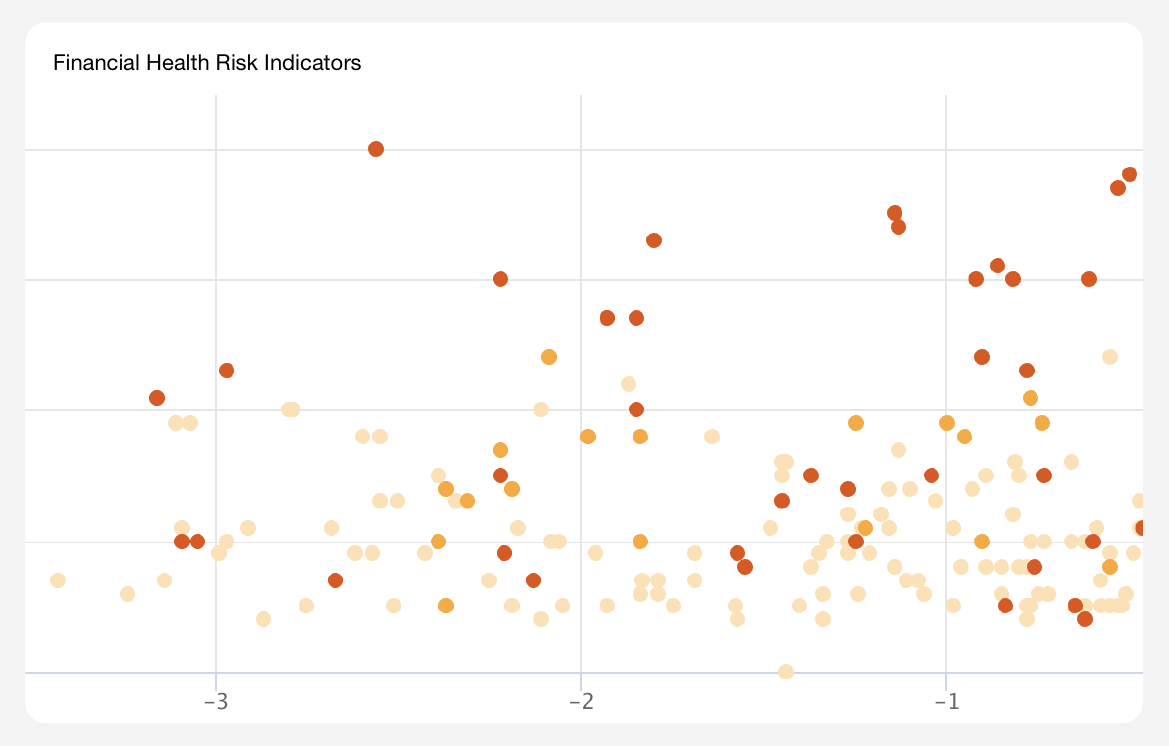

Five-Year Financial Trend Analysis for Innoviva, Inc.

CONSTANT

Credit Trend

136.08%

Total Balance Sheet Growth Rate

41.14%

Total Debt Growth Rate

Innoviva's credit rating stands at A+, which is considered high and indicates strong financial health and low credit risk. The company's credit score is an impressive 98, which is excellent and suggests a strong financial position. The credit trend has been constant, which is a favorable sign as it indicates a stable financial situation.

The company has had one exit, which could suggest a successful divestment or exit strategy. However, the number of funding rounds is limited to one, which could indicate a more mature or stable company. The total funding amount of $225M indicates strong investor confidence in the company's potential and its ability to generate returns.

The cash trend has been increasing, rising from $96.8M in 2014 to $291.05M in 2022, representing a 200.67% change. This growth in cash is a positive sign and suggests a strong liquidity position for the company. However, the short-term investments trend has shown a decrease, dropping from $32.42M in 2016 to -$0 in 2020, which is a concern and may indicate a lack of investment opportunities or a shift in investment strategy.

The total debt trend has been increasing, rising from $382.86M in 2018 to $540.37M in 2022, representing a 41.14% change. This increase in debt may be a concern, as it could indicate a higher level of financial risk. However, the liabilities trend has also been increasing, rising from $389.14M in 2018 to $665.71M in 2022, representing a 71.07% change. This increase in liabilities may be due to the company's investment in research and development or expansion into new markets.

The stockholders equity trend has been increasing, rising from $159.05M in 2018 to $565.79M in 2022, representing a 255.73% change. This growth in equity is a positive sign and suggests that the company is generating significant value for its shareholders. The net income trend has also been increasing, rising from -$168.46M in 2014 to $220.26M in 2022, representing a 230.75% change. This growth in net income is a strong indicator of the company's financial health and profitability.

In conclusion, Innoviva, Inc. has shown a strong financial health over the past five years, with increasing revenue, balance sheet, and cash trends, as well as a high credit rating, excellent credit score, and constant credit trend. However, the decrease in short-term investments and the increase in total debt and liabilities are concerns that should be monitored closely. Overall, Innoviva's financial health is strong and indicates a company that is generating significant value for its shareholders and making strategic investments for future growth.

Financial Health Risk Assessment for Innoviva, Inc.

LOW

Credit Risk

LOW

Bankruptcy Risk

MEDIUM

Financial Health Risk

List of UEIs for Innoviva, Inc.

ABOUT SUPPLIER FINANCIAL HEALTH REPORTS

Ark provides definitive, consolidated analyses of every vendor, subcontractor, supplier, grant awardee, non-profit, and investment organization in the national security and defense sectors. Supplier financial health reports are AI-assisted analyses of the current health and stability of an organization, as well as the trends, trajectory, and risk indicators that partners and stakeholders need to know about.

Explore Additional Analyses

ABOUT ARK.AI

The Ark is the only software platform purpose-built for Defense Acquisition that leverages authoritative commercial data and AI-enabled Applications designed to solve Acquisition challenges. With the Ark, analysts and decision-makers gain the ability to manage Acquisition programs proactively, allowing them to unwind the legacy complexity and effectively field modern warfighting systems that compete with China.

The Leading Defense Acquisition Software.

OUR APPLICATIONS

AI-enabled Applications within The Ark reflect standard workflows across the Defense Acquisition Process. From Science & Technology to Modernization, these Applications allow for the execution of rapid, efficient, data-informed decisions, standardized reporting, and efficient workflow management. The Ark enables your team to transform Defense Acquisition into a strategic advantage.