AbCellera Biologics Inc

Supplier Financial Health Report

Overview

June 2024

CA

Incorporated Country

386

Number of Employees

11

Number of Funding Rounds

2

Count of Investments

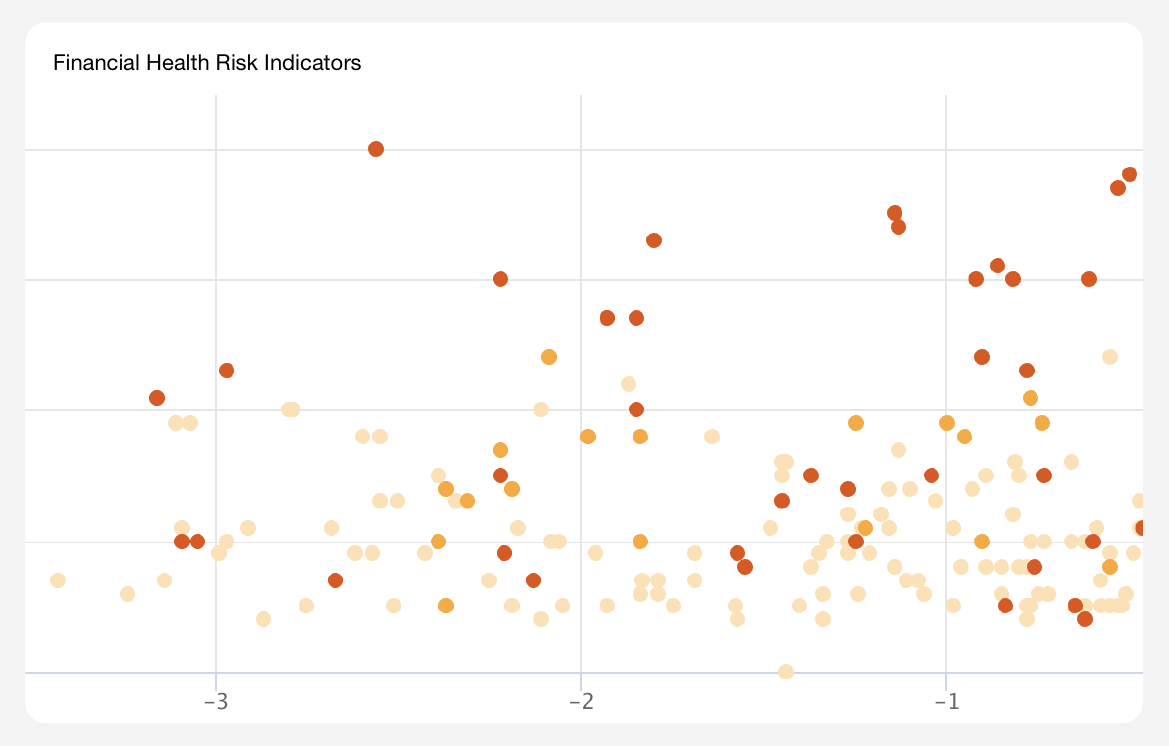

Five-Year Financial Trend Analysis for AbCellera Biologics Inc

--

Credit Trend

53.24%

Total Balance Sheet Growth Rate

75.76%

Total Liabilities Growth Rate

The cash position, however, showed a decrease from $594.12M in 2020 to $386.54M in 2022, a 34.94% decrease. This trend is concerning, as a decrease in cash could indicate operational inefficiencies or increased investment in research and development.

The liabilities also increased from $175.03M in 2020 to $307.63M in 2022, a 75.76% increase. This trend, combined with the decrease in cash, could suggest a potential financial risk.

Despite these concerns, the company's net income, EBITDA, net operating cash flow, and free cash flow all showed significant increases over the past few years. These metrics indicate that the company is generating substantial cash flow and is able to cover its operating expenses and debt obligations.

The company's revenue is heavily dependent on the Canadian market, accounting for 94.74% of total revenue in the most recent year. This concentration of revenue in a single market could pose a risk, as economic or political instability in Canada could negatively impact the company's financial health.

AbCellera Biologics Inc has raised significant funding, with a total of $888.94M across 11 funding rounds. The company's high number of funding rounds and large total funding amount suggest that it is still in its growth phase and may not yet be profitable. However, the company's strong investor interest and ability to generate substantial cash flow indicate a promising future.

In conclusion, AbCellera Biologics Inc has shown significant financial growth over the past few years, but there are concerns regarding the decrease in cash and the increase in liabilities. The company's heavy reliance on the Canadian market for revenue also poses a potential risk. Despite these concerns, the company's strong cash flow and investor confidence suggest a promising future.

Financial Health Risk Assessment for AbCellera Biologics Inc

LOW

Profitability Risk

MEDIUM

Operational Efficiency Risk

LOW

Financial Health Risk

However, there are some concerning trends in the financial data. The cash position decreased from $594.12M in 2020 to $386.54M in 2022, a 34.94% decrease. This decrease in cash could indicate operational inefficiencies or increased investment in research and development. Additionally, liabilities increased from $175.03M in 2020 to $307.63M in 2022, a 75.76% increase. This trend, combined with the decrease in cash, could suggest a potential financial risk.

Despite these concerns, the company's net income, EBITDA, net operating cash flow, and free cash flow all showed significant increases over the past few years. These metrics indicate that the company is generating substantial cash flow and is able to cover its operating expenses and debt obligations. It's important to note that the company's revenue is heavily dependent on the Canadian market, accounting for 94.74% of total revenue in the most recent year. This concentration of revenue in a single market could pose a risk, as economic or political instability in Canada could negatively impact the company's financial health.

The ratio analysis indicates a strong financial position, with a current ratio of 8.67 and a quick ratio of 3.35, both suggesting a healthy liquidity position. The debt-to-equity ratio of 0.25 is quite low, indicating a conservative approach to financing. However, the net profit margin of 0.33 is relatively low, indicating high operating expenses compared to revenue. The return on assets (ROA) and return on equity (ROE) are both below industry averages, suggesting that the company could be more efficient in using its assets and equity to generate earnings.

In conclusion, AbCellera Biologics Inc has shown significant financial growth over the past few years, but there are concerns regarding the decrease in cash and the increase in liabilities. The company's heavy reliance on the Canadian market for revenue also poses a potential risk. Despite these concerns, the company's strong cash flow and investor confidence suggest a promising future. It's essential to closely monitor the company's cash position and liabilities to ensure that operational efficiencies are in place and that the company is able to maintain a healthy financial position.

List of UEIs for AbCellera Biologics Inc

ABOUT SUPPLIER FINANCIAL HEALTH REPORTS

Ark provides definitive, consolidated analyses of every vendor, subcontractor, supplier, grant awardee, non-profit, and investment organization in the national security and defense sectors. Supplier financial health reports are AI-assisted analyses of the current health and stability of an organization, as well as the trends, trajectory, and risk indicators that partners and stakeholders need to know about.

Explore Additional Analyses

ABOUT ARK.AI

The Ark is the only software platform purpose-built for Defense Acquisition that leverages authoritative commercial data and AI-enabled Applications designed to solve Acquisition challenges. With the Ark, analysts and decision-makers gain the ability to manage Acquisition programs proactively, allowing them to unwind the legacy complexity and effectively field modern warfighting systems that compete with China.

The Leading Defense Acquisition Software.

OUR APPLICATIONS

AI-enabled Applications within The Ark reflect standard workflows across the Defense Acquisition Process. From Science & Technology to Modernization, these Applications allow for the execution of rapid, efficient, data-informed decisions, standardized reporting, and efficient workflow management. The Ark enables your team to transform Defense Acquisition into a strategic advantage.